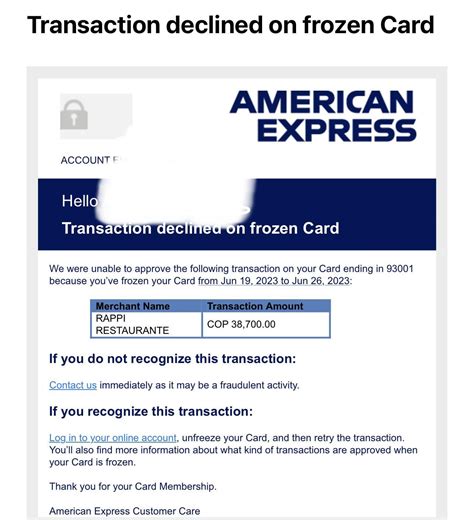

disputing fake shoes on amex | amex fraudulent charges disputing fake shoes on amex Disputes can be complicated. To help make the process a little clearer, we created this step-by-step flowchart of what happens when a Card Member disputes a charge. $19.55

0 · amex open dispute status

1 · amex online dispute

2 · amex fraudulent charges

3 · amex dispute status check

4 · amex dispute a charge

5 · amex credit card fraud

6 · american express fraudulent charges

7 · american express dispute status

This Rolex Explorer II ref 16570 review was originally written and published in the summer of 2019. Back then, I’d “only” had the watch for about 18 months, was still .

You're legally entitled to dispute erroneous or fraudulent credit card charges. Learn how to do it and what your rights are during and after the investigation.

American Express makes it easy to dispute charges, offering multiple options for initiating a dispute. You can contact American Express by phone, mail, online chat, or in your online account to start the dispute process.You can check the status of your disputes on our detailed overview page via this link. This page also includes information such as the dispute initiation date, the category of dispute, any .Disputes can be complicated. To help make the process a little clearer, we created this step-by-step flowchart of what happens when a Card Member disputes a charge. But what happens when consumers start abusing the system by filing false chargeback claims or credit card disputes? In this article, we break down the dispute process, .

If you never got your order and the charge appears on your credit card statement, you can dispute it as a billing error. File a dispute online or by phone with your credit card company. To protect . You can dispute credit card charges with your issuer for three reasons under the Fair Credit Billing Act: Someone else used your card without permission. Say a. fraudster. .

First, reach out to the company that sold the product or service to you. Explain the issue—for example, the product you received was defective or wasn’t what you ordered. Ask . The legal minimum time frame for filing a dispute is 60 days, but some credit card processors allow for a longer window. For example, Visa, Mastercard and American Express .

You're legally entitled to dispute erroneous or fraudulent credit card charges. Learn how to do it and what your rights are during and after the investigation.

American Express makes it easy to dispute charges, offering multiple options for initiating a dispute. You can contact American Express by phone, mail, online chat, or in your online account to start the dispute process. Send a dispute letter to your credit card issuer at the address listed for billing disputes, errors, or inquiries — not the address for sending your payments. Look on your statement, online, or your credit card agreement to get the right address.You can check the status of your disputes on our detailed overview page via this link. This page also includes information such as the dispute initiation date, the category of dispute, any responses or updates from the involved parties, and the expected resolution timeline.

Disputes can be complicated. To help make the process a little clearer, we created this step-by-step flowchart of what happens when a Card Member disputes a charge. But what happens when consumers start abusing the system by filing false chargeback claims or credit card disputes? In this article, we break down the dispute process, and discuss the impact of false credit card dispute claims made by cardholders.If you never got your order and the charge appears on your credit card statement, you can dispute it as a billing error. File a dispute online or by phone with your credit card company. To protect any rights you may have, also send a letter to the address listed for billing disputes or errors. You can dispute credit card charges with your issuer for three reasons under the Fair Credit Billing Act: Someone else used your card without permission. Say a. fraudster. charged a big-screen TV.

First, reach out to the company that sold the product or service to you. Explain the issue—for example, the product you received was defective or wasn’t what you ordered. Ask the company to refund the money or undo the charge. The seller might fix the problem. If not, you have a few ways to proceed. The legal minimum time frame for filing a dispute is 60 days, but some credit card processors allow for a longer window. For example, Visa, Mastercard and American Express each allow. You're legally entitled to dispute erroneous or fraudulent credit card charges. Learn how to do it and what your rights are during and after the investigation. American Express makes it easy to dispute charges, offering multiple options for initiating a dispute. You can contact American Express by phone, mail, online chat, or in your online account to start the dispute process.

Send a dispute letter to your credit card issuer at the address listed for billing disputes, errors, or inquiries — not the address for sending your payments. Look on your statement, online, or your credit card agreement to get the right address.You can check the status of your disputes on our detailed overview page via this link. This page also includes information such as the dispute initiation date, the category of dispute, any responses or updates from the involved parties, and the expected resolution timeline.

Disputes can be complicated. To help make the process a little clearer, we created this step-by-step flowchart of what happens when a Card Member disputes a charge. But what happens when consumers start abusing the system by filing false chargeback claims or credit card disputes? In this article, we break down the dispute process, and discuss the impact of false credit card dispute claims made by cardholders.If you never got your order and the charge appears on your credit card statement, you can dispute it as a billing error. File a dispute online or by phone with your credit card company. To protect any rights you may have, also send a letter to the address listed for billing disputes or errors. You can dispute credit card charges with your issuer for three reasons under the Fair Credit Billing Act: Someone else used your card without permission. Say a. fraudster. charged a big-screen TV.

First, reach out to the company that sold the product or service to you. Explain the issue—for example, the product you received was defective or wasn’t what you ordered. Ask the company to refund the money or undo the charge. The seller might fix the problem. If not, you have a few ways to proceed.

amex open dispute status

buy new rolex datejust

3.77. 144 ratings22 reviews. This book is the only guide you will need to explore all the most important historical sites on the planet. From Stonehenge to the Great Wall of China, from Sterkfontein Caves - the 'cradle of humanity' in South Africa to Checkpoint Charlie, Germany and everywhere inbetween. The book explores all the .

disputing fake shoes on amex|amex fraudulent charges